1

1 The deduction for social Security tax is $4976.86 and the deduction for Medicare tax is $1163.94 .

Step-by-step explanation:

Marika Perez’s gross biweekly pay is $2,768. Her earnings to date for the year total $80,272.

What amount is deducted from her pay for Social Security taxes if the rate is 6.2%?

dollars

dollars

What amount is deducted for Medicare, which is taxed at 1.45%?

dollars

dollars

9

9 $171.62 for social security.

$40.14 for medicare.

Step by step explanation:

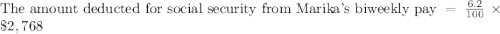

We have been given that Marika Perez’s gross biweekly pay is $2,768.

To find the amount deducted from her pay for social security tax, we will find 6.2% of her biweekly pay.

Therefore, $171.62 is deducted from Marika's biweekly pay.

Now let us find 1.45% of $2768 to find the amount of medicare deducted from her pay.

Therefore, an amount of $40.14 is deducted from Marika's biweekly pay for medicare.

Deduction for social Security tax is $ 4976.864 and deduction for Medicare tax is $ 1163.944 .

Step-by-step explanation:

As given

Marika Perez’s gross biweekly pay is $2,768.

Her earnings to date for the year total $80,272.

Social Security taxes if the rate is 6.2% .

6.2% is written in the decimal form

= 0.062

Social Security taxes = 0.062 × Gross pay

= 0.062 × 80272

= $ 4976.864

As given

Amount is deducted for Medicare is 1.45% .

1.45% is written in the form of decimal

= 0.0145

Medicare tax = 0.0145 × Gross pay

= 0.0145 × 80272

= $ 1163.944

Therefore the deduction for social Security tax is $ 4976.864 and deduction for Medicare tax is $ 1163.944 .

2

2 The deduction for social Security tax is $4976.86 and the deduction for Medicare tax is $1163.94 .

Step-by-step explanation:

Marika Perez’s gross biweekly pay is $2,768. Her earnings to date for the year total $80,272.

What amount is deducted from her pay for Social Security taxes if the rate is 6.2%?

dollars

dollars

What amount is deducted for Medicare, which is taxed at 1.45%?

dollars

dollars

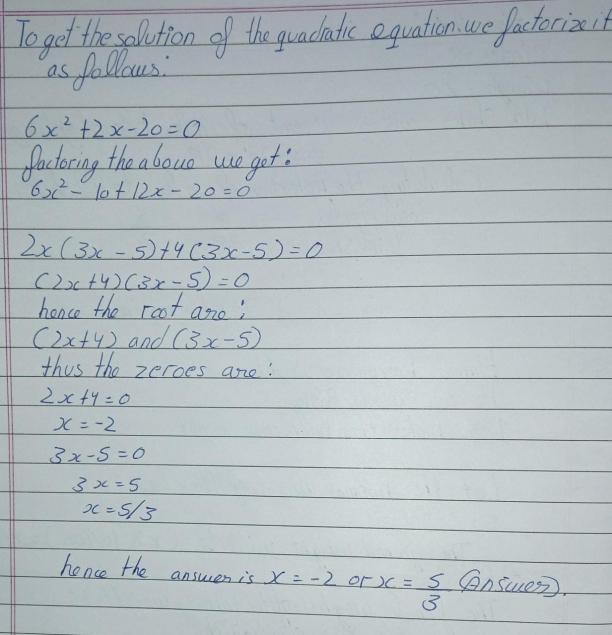

The answer is in the image

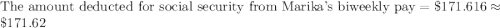

SI=(P*R*T)/100

P=2000

R=1.5

T=6

SI=(2000*1.5*6)/100

=(2000*9)/100

=180

Neil will earn interest of 180

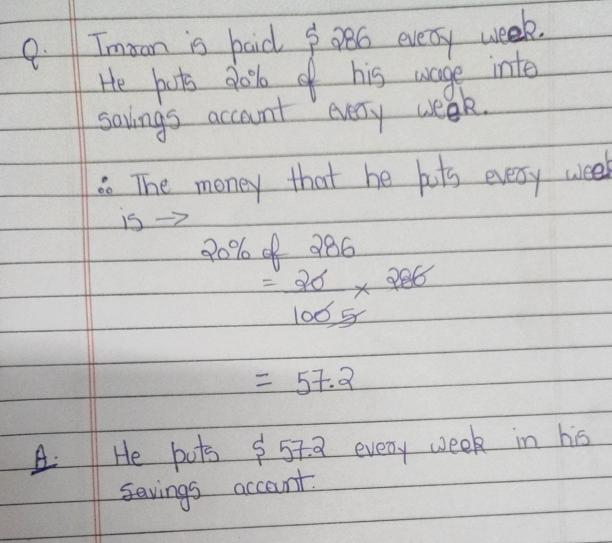

Cost of 7 gallons=$24.50

Cost of 1 gallon=24.50/7=3.5

Cost of 15 gallons=15*3.5=52.5

Cost of 15 gallons will be $52.5

The total nom of code that can be used is equal to 5+3 = 8

The solution is in the following image

The answer is in the image

It will provide an instant answer!