10

10 $468

Step-by-step explanation:

I = P*R*T

I = 300*0.04*14

I = 168

168 + 300 = 468

10

10 $468

Step-by-step explanation:

I = P*R*T

I = 300*0.04*14

I = 168

168 + 300 = 468

a) Interest = $980

b) Principal = $7250

c) Interest rate = 3%

Step-by-step explanation:

a) For Alex

How much interest (in dollars) will Alex receive after 2 years if he deposited $14,000 in the bank at 3.5% annual interest rate?

The formula for Simple Interest = PRT

Where

P = Principal = $14,000

R = Interest rate = 3.5% = 0.035

T = Time = 2 years

I = $14,000 × 0.035 × 2

I = $980

b) For Davit

Davit received $870 as an interest for money invested in Foreign Exchange Market three years ago. How much money did he invest, if the annual interest was 4%

The formula for Simple Interest = PRT

Where

P = Principal = ?

R = Interest rate = 4% = 0.04

I = $870

T = 3 years

years

Solving for P

P = I/RT

P = $870/0.04 × 3

P = $870/0.12

P = $7250

c) For Arthur

. For starting a new business, Arthur borrowed $23000 and calculated $3450 interest for five years. What annual interest was considered?

The formula for Simple Interest = PRT

Where

P = Principal = $23,000

R = Interest rate = ?

I = $3450

T = 5 years

years

We are Solving for R

R = I/PT

R = $3450/$23,000× 5

R = 3450/115000

R = 0.03

Converting to percentage

= 0.03 × 100

= 3%

a) Interest = $980

b) Principal = $7250

c) Interest rate = 3%

Step-by-step explanation:

a) For Alex

How much interest (in dollars) will Alex receive after 2 years if he deposited $14,000 in the bank at 3.5% annual interest rate?

The formula for Simple Interest = PRT

Where

P = Principal = $14,000

R = Interest rate = 3.5% = 0.035

T = Time = 2 years

I = $14,000 × 0.035 × 2

I = $980

b) For Davit

Davit received $870 as an interest for money invested in Foreign Exchange Market three years ago. How much money did he invest, if the annual interest was 4%

The formula for Simple Interest = PRT

Where

P = Principal = ?

R = Interest rate = 4% = 0.04

I = $870

T = 3 years

years

Solving for P

P = I/RT

P = $870/0.04 × 3

P = $870/0.12

P = $7250

c) For Arthur

. For starting a new business, Arthur borrowed $23000 and calculated $3450 interest for five years. What annual interest was considered?

The formula for Simple Interest = PRT

Where

P = Principal = $23,000

R = Interest rate = ?

I = $3450

T = 5 years

years

We are Solving for R

R = I/PT

R = $3450/$23,000× 5

R = 3450/115000

R = 0.03

Converting to percentage

= 0.03 × 100

= 3%

C. $144,200

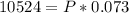

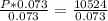

Step-by-step explanation:

We have been given that a borrower's monthly interest payment on an interest-only loan at an annual interest rate of 7.3% is $877.

To find the loan amount, we will use simple interest formula.

, where,

, where,

I = Amount of interest,

P = Principal amount,

r = Annual interest rate in decimal form,

t = Time in years.

One month will be equal to 1/12 year.

Upon substituting our given values in simple interest formula, we will get:

Upon rounding to nearest hundred, we will get:

Therefore, the loan amount was $144,200 and option C is the correct choice.

C. $144,200

Step-by-step explanation:

We have been given that a borrower's monthly interest payment on an interest-only loan at an annual interest rate of 7.3% is $877.

To find the loan amount, we will use simple interest formula.

, where,

, where,

I = Amount of interest,

P = Principal amount,

r = Annual interest rate in decimal form,

t = Time in years.

One month will be equal to 1/12 year.

Upon substituting our given values in simple interest formula, we will get:

Upon rounding to nearest hundred, we will get:

Therefore, the loan amount was $144,200 and option C is the correct choice.

Gig Harbor Boating

Budgeted Income Statement using absorption costing format:

Sales Revenue $985,000

Cost of Boats Sold 730,000

Gross profit $255,000

Total variable selling and

administrative expenses $25,000

Fixed selling and

administrative expenses (per year) 196,000 $221,000

Income before interest and taxes $34,000

Interest expense for the year 13,000

Pretax Income $21,000

2. Down Under Products, Ltd. of Australia

Production Budget for the second quarter

April May June Total

Sales in Units 74,000 85,000 114,000 273,000

Ending Inventory 8,500 11,400 9,200 9,200

Beginning Inventory 740 8,500 11,400 740

Units to be produced 81,760 87,900 111,800 241,460

3. Garden Depot

Summary of Cash Budget for the upcoming fiscal year:

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Beginning cash bal. $25,000 $10,000 $63,800 $98,800

Total cash receipts $310,000 $430,000 $360,000 $380,000

Total cash available $335,000 $440,000 $423,800 $478,800

Total cash

disbursements ($365,000) ($335,000) ($325,000) ($345,000)

Bank loan (repyt) 40,000 (40,000)

Bank loan Interest (1,200)

Cash Balance ($30,000) $63,800 $98,800 $133,800

Required Minimum $10,000 $10,000 $10,000 $10,000

4. Mecca Copy

Budgeted Balance Sheet for the coming year:

Budgeted Balance Sheet for the next year:

Ending Balances

Cash $ 18,200

Accounts receivable $ 8,500

Supplies inventory $ 4,700

Equipment $ 36,000

Accumulated depreciation $ 14,600 $ 21,400

Total Assets $ 52,800

Accounts payable $ 2,200

Common stock $ 5,000

Retained earnings $ 45,600

Total Liabilities and Equity $ 52,800

Explanation:

1. Gig Harbor Boating:

Data and Calculations:

Budgeted unit sales 500

Selling price per unit $1,970

Sales Revenue = $985,000 ($1,970 x 500)

Cost per unit $1,460

Cost of Boats Sold = $730,000 ($1,460 x 500)

Variable selling and administrative expenses (per unit) $ 50

Total variable selling and administrative expenses = $25,000 ($50 x 500 )

Fixed selling and administrative expenses (per year) $196,000

Interest expense for the year $ 13,000

2. Down Under Products, Ltd., of Australia has budgeted sales of its popular boomerang for the next four months as follows:

a) Data and Calculations:

March April May June July

Sales in Units 7,400 74,000 85,000 114,000 92,000

Ending Inventory 740 8,500 11,400 9,200

Beginning Inventory 740 8,500 11,400 9,200

Units to be produced 81,760 87,900 111,800

3. Garden Depot

Data and Calculations:

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Beginning cash bal. $25,000 $10,000 $63,800 $98,800

Total cash receipts $310,000 $430,000 $360,000 $380,000

Total cash available $335,000 $440,000 $423,800 $478,800

Total cash

disbursements ($365,000) ($335,000) ($325,000) ($345,000)

Bank loan (repyt) 40,000 (40,000)

Bank loan Interest (1,200)

Cash Balance ($30,000) $63,800 $98,800 $133,800

Required Minimum $10,000 $10,000 $10,000 $10,000

4. Mecca Copy:

Data and Calculations:

Budgeted Balance Sheet for the next year:

Ending Balances

Cash ?

Accounts receivable $ 8,500

Supplies inventory $ 4,700

Equipment $ 36,000

Accumulated depreciation $ 14,600

Accounts payable $ 2,200

Common stock $ 5,000

Retained earnings ?

Retained Earnings:

Beginning = $32,000

Net income = 16,300

Dividends = (2,700)

Ending = $45,600

Gig Harbor Boating's budgeted income statement gives a snapshot into the future of its revenue, cost of boats sold, gross profit, and pretax income. Thus, it uses the projections to guide management towards the achievement of its targets.

Similarly, Down Under Products, Ltd. of Australia prepares a production budget for the second quarter to determine how much units it needs to produce to meet sales or customers' demand.

Garden Depot, as a retailer, ascertains its cash needs by preparing budgeted cash flows for the coming year.

Finally, Mecca Copy cannot operate its center without an idea about its financial position for the next year. Therefore, it prepares a budgeted balance sheet. All these budgets guide managements of these various entities and prepare them for taking necessary actions to plan and keep their companies afloat.

Gig Harbor Boating

Budgeted Income Statement using absorption costing format:

Sales Revenue $985,000

Cost of Boats Sold 730,000

Gross profit $255,000

Total variable selling and

administrative expenses $25,000

Fixed selling and

administrative expenses (per year) 196,000 $221,000

Income before interest and taxes $34,000

Interest expense for the year 13,000

Pretax Income $21,000

2. Down Under Products, Ltd. of Australia

Production Budget for the second quarter

April May June Total

Sales in Units 74,000 85,000 114,000 273,000

Ending Inventory 8,500 11,400 9,200 9,200

Beginning Inventory 740 8,500 11,400 740

Units to be produced 81,760 87,900 111,800 241,460

3. Garden Depot

Summary of Cash Budget for the upcoming fiscal year:

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Beginning cash bal. $25,000 $10,000 $63,800 $98,800

Total cash receipts $310,000 $430,000 $360,000 $380,000

Total cash available $335,000 $440,000 $423,800 $478,800

Total cash

disbursements ($365,000) ($335,000) ($325,000) ($345,000)

Bank loan (repyt) 40,000 (40,000)

Bank loan Interest (1,200)

Cash Balance ($30,000) $63,800 $98,800 $133,800

Required Minimum $10,000 $10,000 $10,000 $10,000

4. Mecca Copy

Budgeted Balance Sheet for the coming year:

Budgeted Balance Sheet for the next year:

Ending Balances

Cash $ 18,200

Accounts receivable $ 8,500

Supplies inventory $ 4,700

Equipment $ 36,000

Accumulated depreciation $ 14,600 $ 21,400

Total Assets $ 52,800

Accounts payable $ 2,200

Common stock $ 5,000

Retained earnings $ 45,600

Total Liabilities and Equity $ 52,800

Explanation:

1. Gig Harbor Boating:

Data and Calculations:

Budgeted unit sales 500

Selling price per unit $1,970

Sales Revenue = $985,000 ($1,970 x 500)

Cost per unit $1,460

Cost of Boats Sold = $730,000 ($1,460 x 500)

Variable selling and administrative expenses (per unit) $ 50

Total variable selling and administrative expenses = $25,000 ($50 x 500 )

Fixed selling and administrative expenses (per year) $196,000

Interest expense for the year $ 13,000

2. Down Under Products, Ltd., of Australia has budgeted sales of its popular boomerang for the next four months as follows:

a) Data and Calculations:

March April May June July

Sales in Units 7,400 74,000 85,000 114,000 92,000

Ending Inventory 740 8,500 11,400 9,200

Beginning Inventory 740 8,500 11,400 9,200

Units to be produced 81,760 87,900 111,800

3. Garden Depot

Data and Calculations:

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Beginning cash bal. $25,000 $10,000 $63,800 $98,800

Total cash receipts $310,000 $430,000 $360,000 $380,000

Total cash available $335,000 $440,000 $423,800 $478,800

Total cash

disbursements ($365,000) ($335,000) ($325,000) ($345,000)

Bank loan (repyt) 40,000 (40,000)

Bank loan Interest (1,200)

Cash Balance ($30,000) $63,800 $98,800 $133,800

Required Minimum $10,000 $10,000 $10,000 $10,000

4. Mecca Copy:

Data and Calculations:

Budgeted Balance Sheet for the next year:

Ending Balances

Cash ?

Accounts receivable $ 8,500

Supplies inventory $ 4,700

Equipment $ 36,000

Accumulated depreciation $ 14,600

Accounts payable $ 2,200

Common stock $ 5,000

Retained earnings ?

Retained Earnings:

Beginning = $32,000

Net income = 16,300

Dividends = (2,700)

Ending = $45,600

Gig Harbor Boating's budgeted income statement gives a snapshot into the future of its revenue, cost of boats sold, gross profit, and pretax income. Thus, it uses the projections to guide management towards the achievement of its targets.

Similarly, Down Under Products, Ltd. of Australia prepares a production budget for the second quarter to determine how much units it needs to produce to meet sales or customers' demand.

Garden Depot, as a retailer, ascertains its cash needs by preparing budgeted cash flows for the coming year.

Finally, Mecca Copy cannot operate its center without an idea about its financial position for the next year. Therefore, it prepares a budgeted balance sheet. All these budgets guide managements of these various entities and prepare them for taking necessary actions to plan and keep their companies afloat.

1

1 $ 170

Explanation:

Opportunity cost in the value of the missed alternative. It is the foregone benefit as a result of choosing one item over another. In the case of John, the opportunity cost is the interest receivable forfeited as a result of engaging in the lawn moving business.

The interest missed include :

1. 3 percent interest on $ 1000 savings

= 3/100 x 1000= $ 30

7 percent interest on $ 2000 on loan

= 7/100 x 2000= $ 140

Total opportunity cost = $30 + $ 140

= $ 170

1

1 $ 170

Explanation:

Opportunity cost in the value of the missed alternative. It is the foregone benefit as a result of choosing one item over another. In the case of John, the opportunity cost is the interest receivable forfeited as a result of engaging in the lawn moving business.

The interest missed include :

1. 3 percent interest on $ 1000 savings

= 3/100 x 1000= $ 30

7 percent interest on $ 2000 on loan

= 7/100 x 2000= $ 140

Total opportunity cost = $30 + $ 140

= $ 170

It will provide an instant answer!