1

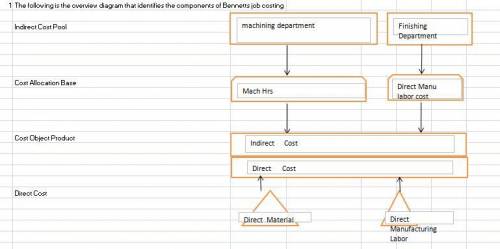

1 Explanation:

1) is attached below

2) Budgeted manufacturing overhead rate :

In Machining Department = Manufacturing overhead cost / Machine hrs

= $9065000 /185,000 = $49 per machine hour

In Finishing Department = Manufacturing overhead cost / Direct Manufacturing labor cost

= $8,058000 / $3950,000 = 2.04

3) Machining Department overhead = $20 per machine hr * 100 hrs

= $2000

Finishing Department overhead = $1400 * 204% = $2856

Total manufacturing overhead = $4856

4).Total costs of Job 431:

Direct material - Machining Department = $14500

- Finishing Department = $4000

Direct manufacturing labor - Machining Department = $800

- Finishing Department = $1400

Manufacturing overhead = $4856

Total Cost = $25556

Cost per unit = $25556 / 100 = $255.56

5)

Actual manufacturing overhead machining finishing

Actual manufacturing overhead $12,010,000 $9,184,000

Manufacturing overhead allocated $11,760,000 $9,384,000

($49×240,000)(204%×4600,000)

Under allocated(over allocated) $250,000 $(200,000.00)

For plant as whole:

(12,010,000+$9184,000)-(11760,000+$9384,000)

50000 Under applied.

6) In machining department main focal points is machines , so machine hours is selected for this.In finishing department, labor cost is key area.so it is selected by the company .In both department key area is different so different cost drivers are selected for both departments.

1

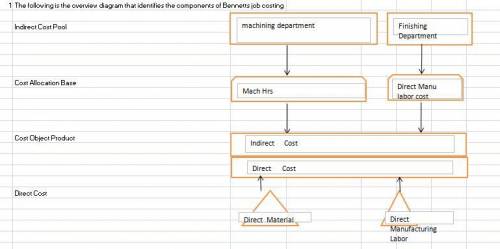

1 Explanation:

1) is attached below

2) Budgeted manufacturing overhead rate :

In Machining Department = Manufacturing overhead cost / Machine hrs

= $9065000 /185,000 = $49 per machine hour

In Finishing Department = Manufacturing overhead cost / Direct Manufacturing labor cost

= $8,058000 / $3950,000 = 2.04

3) Machining Department overhead = $20 per machine hr * 100 hrs

= $2000

Finishing Department overhead = $1400 * 204% = $2856

Total manufacturing overhead = $4856

4).Total costs of Job 431:

Direct material - Machining Department = $14500

- Finishing Department = $4000

Direct manufacturing labor - Machining Department = $800

- Finishing Department = $1400

Manufacturing overhead = $4856

Total Cost = $25556

Cost per unit = $25556 / 100 = $255.56

5)

Actual manufacturing overhead machining finishing

Actual manufacturing overhead $12,010,000 $9,184,000

Manufacturing overhead allocated $11,760,000 $9,384,000

($49×240,000)(204%×4600,000)

Under allocated(over allocated) $250,000 $(200,000.00)

For plant as whole:

(12,010,000+$9184,000)-(11760,000+$9384,000)

50000 Under applied.

6) In machining department main focal points is machines , so machine hours is selected for this.In finishing department, labor cost is key area.so it is selected by the company .In both department key area is different so different cost drivers are selected for both departments.

WoolCorp

1. Single Plantwide Factory Overhead Rate: $652

2. Comparison of WoolCorp’s current method with activity-based costing:

Raw Wool Wool Yarn

Allocated factory

overhead cost $45,640 $19,560

Activity-Based Costing $17,840 $47,640

3. Calculation of and entering the activity rate for each of the three activities:

Activity Activity Rate

Sorting $6.40 ($25,600/4,000)

Cleaning $6.00 ($38,400/6,400)

Combing $12.00 $1,200/100)

4. Allocation of the costs of sorting, cleaning, and combing to product:

Raw Wool Wool Yarn

Sorting cost $5,120 $20,400

Cleaning cost 11,520 26,880

Combing cost 840 360

Total cost $17,840 $47,640

5. Recommended method of costing:

Activity-based costing, because it recognizes differences in how each product uses factory overhead activities, yielding more accurate product costs.

Explanation:

Key Decisions: product offerings, pricing, and vendors

Problem: method of assigning overhead to products

Products:

(1) raw, clean wool to be used as stuffing or insulation and

(2) wool yarn for use in the textile industry

Requirement: evaluate its costing methods for its raw wool and wool yarn.

Traditional Costing Method : Predetermined overhead rate computed as follows:

Single Plantwide Factory Overhead Rate= (Total Budgeted Factory Overhead) ÷ (Total Budgeted Plantwide Allocation Base) combing machine hours

Data for the production of 550 pounds of either raw wool or wool yarn:

Factory Overhead Type Budgeted Factory Overhead

Sorting $25,600

Cleaning $38,400

Combing $1,200

Total overhead $65,200

Raw Wool Wool Yarn

Hours of combing

machine use required 70 30

Compiled Information:

Type of Cost Activity Base Total Cost Rate

Sorting Hours of sorting $25,600

Cleaning Units of cleaning

machine power $38,400

Combing Hours of combing

machine use $1,200

Raw Wool Wool Yarn Total

Hours of sorting required 800 3,200 4,000

Units of cleaning machine

power required 1,920 4,480 6,400

Hours of combing

machine use required 70 30 100

1.Overhead Rate = Overhead Costs/ Direct Labor Costs

Budget Overhead Rate = 3060,000/ 1700,000= 1.8

Actual Overhead Rate = 3217,500/ 1650,000= 1.895

Dakota Products

Budget for 2017 Actual Results for 2017

Direct material costs $2,250,000 $2,150,000

Direct manufacturing labor costs 1,700,000 1,650,000

Manufacturing overhead costs 3,060,000 3,217,500

2.During March, the job-cost record for Job 626

Direct materials used $55,000

Direct manufacturing labor costs $45,000

Actual Overhead = 1.895 * $45,000= $ 85295.45

Normal Overhead = 1.8 * 45,000= $ 81,000

2.The actual cost of Job 626 =$ 55,000+ $ 45,000+ $ 85295.45= $ 185,295.45

2.The normal cost of Job 626 =$ 55,000+ $ 45,000+ $ 81,000= $181,000

3. Under- or Overallocated Overhead under normal costing=

Budgeted Overhead - Actual Overhead= 3,060,000 - 3,217,500=

157,500 underapplied

There is no under- or overallocated overhead under actual costing because overhead costs actually are at their actual costs. There is no difference between calculated and actual.

4. Normal Costing would give an idea before 2017 and it is easier to make decision prior to changes. Actual results can only be obtained after the process. Managers find it easier to pre plan . So normal costing is adoptable.

WoolCorp

1. Single Plantwide Factory Overhead Rate: $652

2. Comparison of WoolCorp’s current method with activity-based costing:

Raw Wool Wool Yarn

Allocated factory

overhead cost $45,640 $19,560

Activity-Based Costing $17,840 $47,640

3. Calculation of and entering the activity rate for each of the three activities:

Activity Activity Rate

Sorting $6.40 ($25,600/4,000)

Cleaning $6.00 ($38,400/6,400)

Combing $12.00 $1,200/100)

4. Allocation of the costs of sorting, cleaning, and combing to product:

Raw Wool Wool Yarn

Sorting cost $5,120 $20,400

Cleaning cost 11,520 26,880

Combing cost 840 360

Total cost $17,840 $47,640

5. Recommended method of costing:

Activity-based costing, because it recognizes differences in how each product uses factory overhead activities, yielding more accurate product costs.

Explanation:

Key Decisions: product offerings, pricing, and vendors

Problem: method of assigning overhead to products

Products:

(1) raw, clean wool to be used as stuffing or insulation and

(2) wool yarn for use in the textile industry

Requirement: evaluate its costing methods for its raw wool and wool yarn.

Traditional Costing Method : Predetermined overhead rate computed as follows:

Single Plantwide Factory Overhead Rate= (Total Budgeted Factory Overhead) ÷ (Total Budgeted Plantwide Allocation Base) combing machine hours

Data for the production of 550 pounds of either raw wool or wool yarn:

Factory Overhead Type Budgeted Factory Overhead

Sorting $25,600

Cleaning $38,400

Combing $1,200

Total overhead $65,200

Raw Wool Wool Yarn

Hours of combing

machine use required 70 30

Compiled Information:

Type of Cost Activity Base Total Cost Rate

Sorting Hours of sorting $25,600

Cleaning Units of cleaning

machine power $38,400

Combing Hours of combing

machine use $1,200

Raw Wool Wool Yarn Total

Hours of sorting required 800 3,200 4,000

Units of cleaning machine

power required 1,920 4,480 6,400

Hours of combing

machine use required 70 30 100

1.Overhead Rate = Overhead Costs/ Direct Labor Costs

Budget Overhead Rate = 3060,000/ 1700,000= 1.8

Actual Overhead Rate = 3217,500/ 1650,000= 1.895

Dakota Products

Budget for 2017 Actual Results for 2017

Direct material costs $2,250,000 $2,150,000

Direct manufacturing labor costs 1,700,000 1,650,000

Manufacturing overhead costs 3,060,000 3,217,500

2.During March, the job-cost record for Job 626

Direct materials used $55,000

Direct manufacturing labor costs $45,000

Actual Overhead = 1.895 * $45,000= $ 85295.45

Normal Overhead = 1.8 * 45,000= $ 81,000

2.The actual cost of Job 626 =$ 55,000+ $ 45,000+ $ 85295.45= $ 185,295.45

2.The normal cost of Job 626 =$ 55,000+ $ 45,000+ $ 81,000= $181,000

3. Under- or Overallocated Overhead under normal costing=

Budgeted Overhead - Actual Overhead= 3,060,000 - 3,217,500=

157,500 underapplied

There is no under- or overallocated overhead under actual costing because overhead costs actually are at their actual costs. There is no difference between calculated and actual.

4. Normal Costing would give an idea before 2017 and it is easier to make decision prior to changes. Actual results can only be obtained after the process. Managers find it easier to pre plan . So normal costing is adoptable.

A. Particular Direct Indirect Variable Fixed

1 Wages of Assembly Yes No Yes No

2 Deprecation of plant & No Yes No Yes

Machinery

3 Glue & Thread No No Yes No

4 Outbound Shipping Cost No Yes No Yes

5 Raw Material Handling Cost Yes No Yes No

6Salary Of Public Relations No Yes No Yes

manager

7 Production Run Setup Costs Yes No Yes No

8 Plant Utilities Yes No Yes No

9 Electricity cost of retail stores No Yes Yes No

10 Research and development No Yes No Yes

expense

B. Product-Costing

i. Manufacturing Cost Per Machine Hour = Total Manufacturing overhead / Total Machine Hours

Manufacturing Cost Per Machine Hour = 359,520.00 / 21,400.00

Manufacturing Cost Per Machine Hour = 16.80

ii. Particular Amount

Raw Material $6,240

Direct Labor Cost $9,165

$15,405

Manufacturing overhead $13,104

(780 hours* $16.80)

Total Cost of 3900 Hats $28509

Thus, the Cost of One hat = $28509 / 3900 hat = $7.31 per hat

iii. Total Hats made During the Month Of April 3,900

Less: Closing Inventory 1,050

Sold During the month of April 2,850

Cost Of Hats Sold During the month of April

= 2,850 * $7.31

= $20,833.5

Cost of Closing Stock (1,050 hat) = 1,050 hat * $7.31 = 7675.5

4

4 Answer for the question:

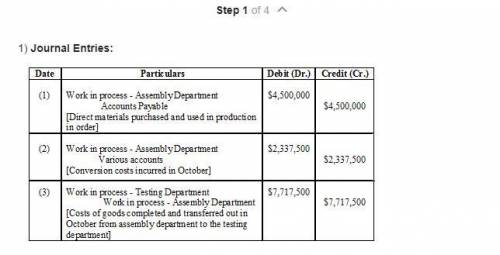

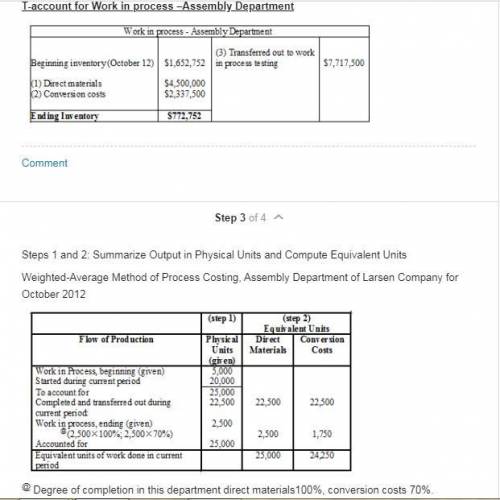

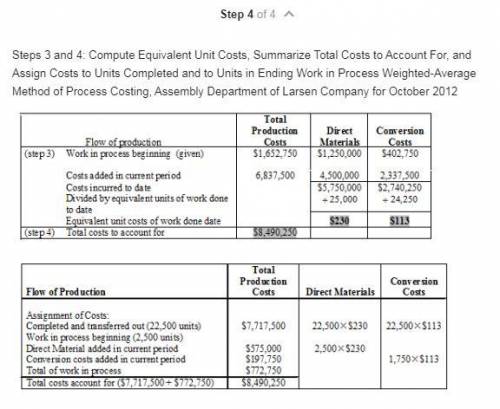

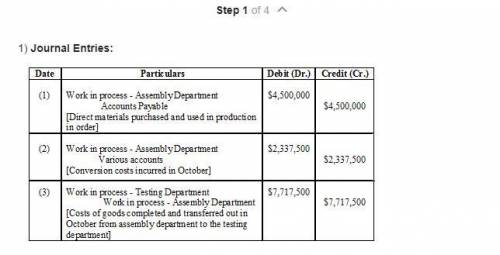

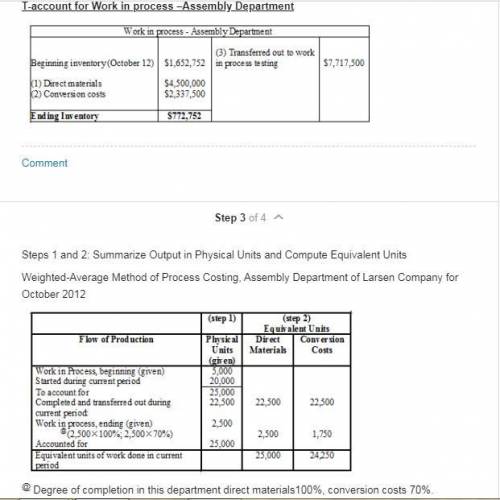

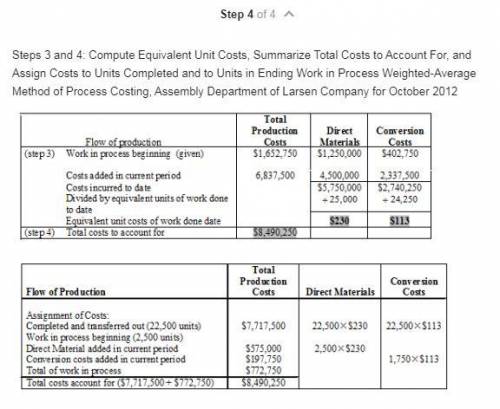

Larsen company manufactures car seats in its San Antonio plant. Each car seat passes through the Assembly department and the Testing Department. This problem focuses on the Assembly Department. The process-costing system at Larsen Company has a single direct-cost category ( direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the process. Conversion costs are added evenly during the process. When the Assembly Department finishes work on each car seat, it is immediately transferred to Testing.

Larsen Company uses the weighted-average method of process costing. Data for the Assembly Department for October 2009 are:

the physical units are the car seats

Physical Units Direct Materials Conversion Costs

work in process

october 1(a) 5,000 $1,250,000 $402,750

started during

october 2009 20,000

completed during

october 2009 22,500

work in process

october 31(b) 2,500

total costs added

during october 2009 $4,500,000 $2,337,500

a-degree of completion: direct materials ?%: conversion costs, 60%

b-degree of completion: direct materials ?%: conversion costs, 70%

1. For each costs category, compute equivalent units in the Assemly Department. Show physical units in the first column of your schedule.

2. What issues should the manager focus on when reviewing the equivalent units calculation?

3. For each cost category, summarize total assembly department costs for Octoer 2014 and calculate the costs per equivalent unit.

4. Assign costs to units completed and transferred out and to units in ending work in process.

Is given in the attachment.

Explanation:

1

1 Kindly check attached picture

Explanation:

Required:

1. According to the activity-based costing system, what is the total cost of serving each of the following parties of diners? (Round your intermediate calculations and final answers to 2 decimal places.)

a. A party of four dinners who order three drinks-?

b. A party of two dinners who do not order any drinks-?

c. A party of one dinner who order two drinks-?

2. Convert the total costs you computed in (1) above to costs per diner. In other words, what is the average cost per diner for serving each of the following parties? (Round your intermediate calculations to 2 decimal places and final answers to 3 decimal places.)

a. A party of four dinners who order three drinks-?

b. A party of two dinners who do not order any drinks-?

c. A party of one dinner who order two drinks-?

Kindly check attached picture for detailed explanation.

4

4 Answer for the question:

Larsen company manufactures car seats in its San Antonio plant. Each car seat passes through the Assembly department and the Testing Department. This problem focuses on the Assembly Department. The process-costing system at Larsen Company has a single direct-cost category ( direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the process. Conversion costs are added evenly during the process. When the Assembly Department finishes work on each car seat, it is immediately transferred to Testing.

Larsen Company uses the weighted-average method of process costing. Data for the Assembly Department for October 2009 are:

the physical units are the car seats

Physical Units Direct Materials Conversion Costs

work in process

october 1(a) 5,000 $1,250,000 $402,750

started during

october 2009 20,000

completed during

october 2009 22,500

work in process

october 31(b) 2,500

total costs added

during october 2009 $4,500,000 $2,337,500

a-degree of completion: direct materials ?%: conversion costs, 60%

b-degree of completion: direct materials ?%: conversion costs, 70%

1. For each costs category, compute equivalent units in the Assemly Department. Show physical units in the first column of your schedule.

2. What issues should the manager focus on when reviewing the equivalent units calculation?

3. For each cost category, summarize total assembly department costs for Octoer 2014 and calculate the costs per equivalent unit.

4. Assign costs to units completed and transferred out and to units in ending work in process.

Is given in the attachment.

Explanation:

It will provide an instant answer!