Answer:

Answer shown below.Step-by-step explanation:

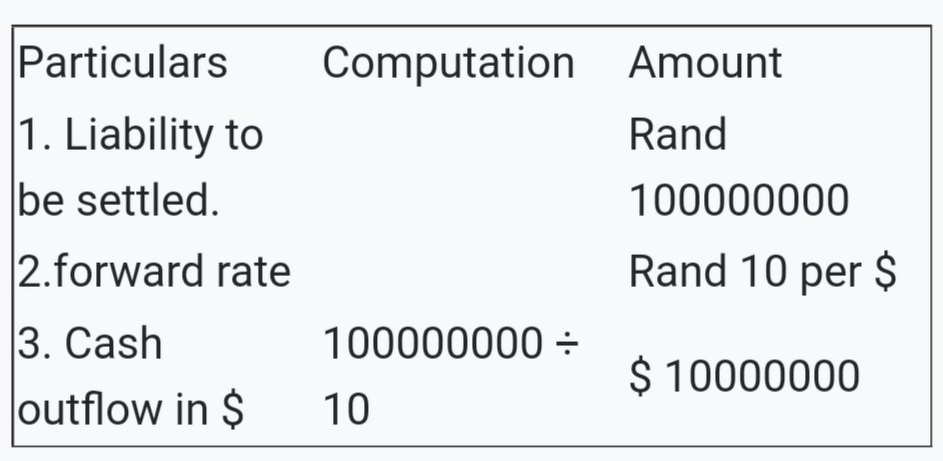

1. Forward contract hedge.

Computation of cash outflow in $ .

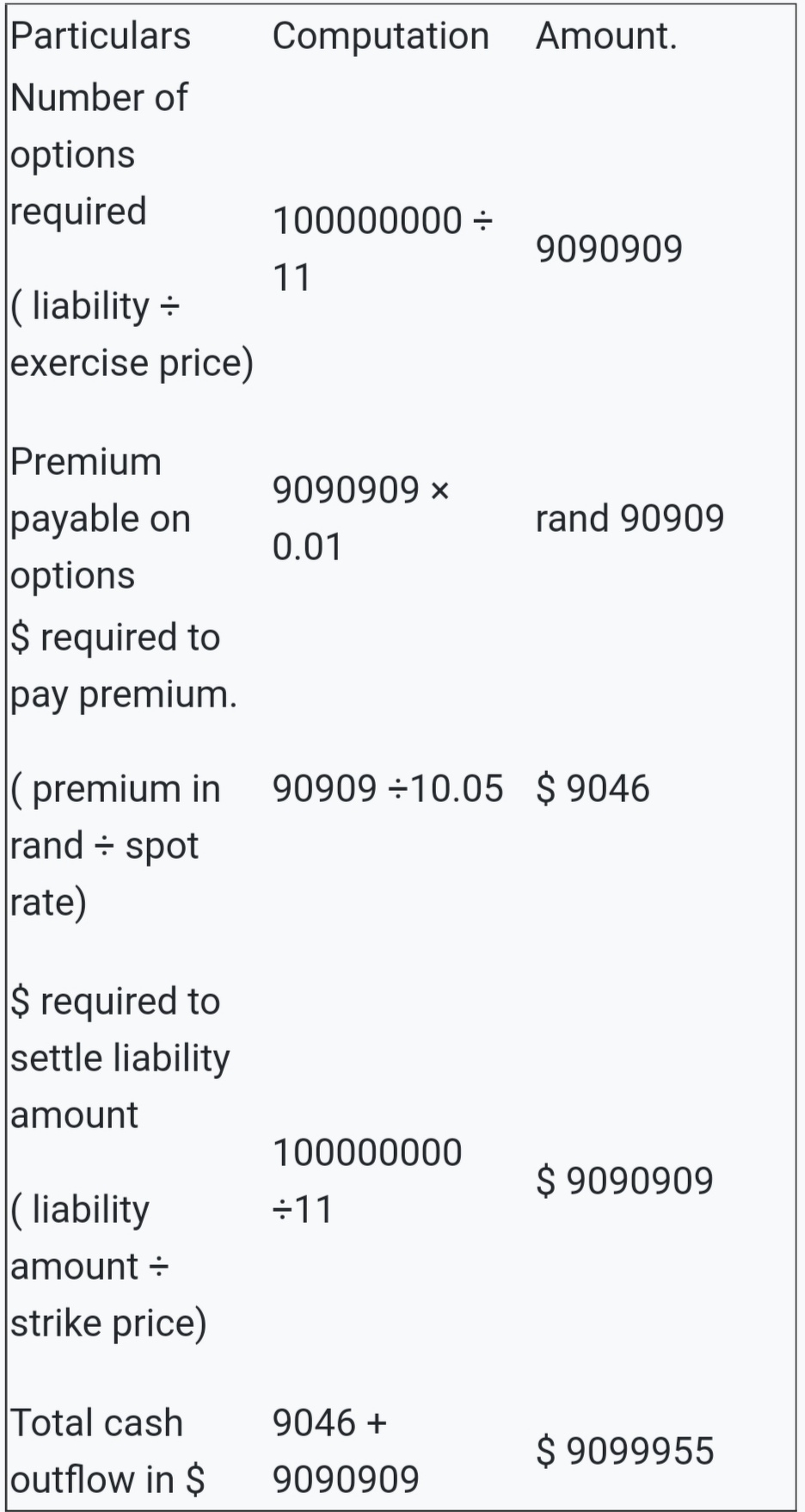

2. Options hedging.

Since rands are required to be purchased and option is available in terms of" rand per $" , hence Put option is relevant.

Computation of cash outflow under options.

1. Cash outflow in $ under forward contract option = $ 10000000

2. Cash outflow in $ under options hedge

= $ 9099955

Cash outflow in $ is less in options hedging as compared to forward contract.

Hence, hedging should be preferred due to lower cash outflows.