37.5%

Step-by-step explanation:

the percentage is calculated as a fraction of the quantities multiplied by 100% , that is

× 100% = 0.375 × 100% = 37.5%

× 100% = 0.375 × 100% = 37.5%

Computer Tycoon, Inc.

1. Horizontal Analysis, calculating the year-over-year changes in each line:

Computer Tycoon, Inc. Income Statements For the Year Ended December 31

2016 2015 Dollars %

Sales Revenue $108,000 $132,000 -$24,000 -18.2%

Cost of Goods Sold 64,000 74,700 -$10,700 -14.3%

Gross Profit 44,000 57,300 -$13,300 -23.2%

Selling, General, & Administrative

Expenses 36,800 38,600 -$1,800 -4.7%

Interest Expense 580 515 $65 +12.6%

Income before Income Tax Exp. 6,620 18,185 -$11,565 -63.6%

Income Tax Expense 1,500 5,800 -$4,300 -74.1%

Net Income $5,120 $12,385 -$7,265 -58.7%

2-A. Vertical analysis by expressing each line as a percentage of total revenues:

Computer Tycoon, Inc. Income Statements For the Year Ended December 31

2016 % 2015 %

Sales Revenue $108,000 100 $132,000 100

Cost of Goods Sold 64,000 59 74,700 56.6

Gross Profit 44,000 41 57,300 43.4

Selling, General, & Administrative

Expenses 36,800 34 38,600 29.2

Interest Expense 580 0.5 515 0.4

Income before Income Tax Exp. 6,620 6 18,185 13.8

Income Tax Expense 1,500 1.4 5,800 4.4

Net Income $5,120 4.7 $12,385 9.4

2-B No. It made less profit per dollar of sales in 2016 compared to 2015.

Explanation:

a) Horizontal analysis is the analysis of financial statements to show changes in the amounts of corresponding financial statement items over a period of time. It is used to evaluate the trend situations, using financial statements for two or more periods.

b) Vertical analysis is another technique for analyzing financial statements with each line item being listed as a percentage of a base figure within the statement. For income statement, the base figure is usually the Sales Revenue, while for balance sheet, the base figure is the total assets.

Computer Tycoon, Inc.

1. Horizontal Analysis, calculating the year-over-year changes in each line:

Computer Tycoon, Inc. Income Statements For the Year Ended December 31

2016 2015 Dollars %

Sales Revenue $108,000 $132,000 -$24,000 -18.2%

Cost of Goods Sold 64,000 74,700 -$10,700 -14.3%

Gross Profit 44,000 57,300 -$13,300 -23.2%

Selling, General, & Administrative

Expenses 36,800 38,600 -$1,800 -4.7%

Interest Expense 580 515 $65 +12.6%

Income before Income Tax Exp. 6,620 18,185 -$11,565 -63.6%

Income Tax Expense 1,500 5,800 -$4,300 -74.1%

Net Income $5,120 $12,385 -$7,265 -58.7%

2-A. Vertical analysis by expressing each line as a percentage of total revenues:

Computer Tycoon, Inc. Income Statements For the Year Ended December 31

2016 % 2015 %

Sales Revenue $108,000 100 $132,000 100

Cost of Goods Sold 64,000 59 74,700 56.6

Gross Profit 44,000 41 57,300 43.4

Selling, General, & Administrative

Expenses 36,800 34 38,600 29.2

Interest Expense 580 0.5 515 0.4

Income before Income Tax Exp. 6,620 6 18,185 13.8

Income Tax Expense 1,500 1.4 5,800 4.4

Net Income $5,120 4.7 $12,385 9.4

2-B No. It made less profit per dollar of sales in 2016 compared to 2015.

Explanation:

a) Horizontal analysis is the analysis of financial statements to show changes in the amounts of corresponding financial statement items over a period of time. It is used to evaluate the trend situations, using financial statements for two or more periods.

b) Vertical analysis is another technique for analyzing financial statements with each line item being listed as a percentage of a base figure within the statement. For income statement, the base figure is usually the Sales Revenue, while for balance sheet, the base figure is the total assets.

1

1 Apple Inc.

a. Calculate Apple Inc.'s working capital, current ratio, and acid-test ratio at September 27, 2014, and September 28, 2013. (Round your ratio answers to 1 decimal place. Enter "Working capital" in million of dollars.)

September 2014:

a) Working Capital = Current Assets - Current Liabilities

= $45,660,000 - $34,978,000 = $10,682,000

b) Current Ratio = Current Assets / Current Liabilities

= $45,660 / $34,978 = 1.3 : 1

c) Acid-Test Ratio = Current Assets - Inventory / Current Liabilities

= $45,660 - 930 / $34,978 = 1.3 : 1

September 2013:

a) Working Capital = Current Assets - Current Liabilities

= $41,940,000 - $21,160,000 = $20,780,000

b) Current Ratio = Current Assets / Current Liabilities

= $41,940 / $21,160 = 2 : 1

c) Acid-Test Ratio Current Assets - Inventory / Current Liabilities

= $41,940 -1,200 / $21,160 = 1.9 : 1

b. Calculate Apple's ROE for the years ended September 27, 2014, and September 28, 2013. (Round your answers to 1 decimal place.)

September 2014

ROE = Net Income/Equity x 100 = $26,050/$77,290 x 100 = 33.7%

September 2013

ROE = Net Income/Equity x 100 = $14,160/$48,050 x 100 = 29.5%

c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 27, 2014, and September 28, 2013. (Round "Turnover" answers to 2 decimal places. Round your percentage answers to 1 decimal place.)

September 2014

ROI = Margin x Turnover = Net Operating Income/Sales x Sales/Average Assets

= ($33,950/$108,400) x ($108,400/$120,880)

= 0.31 x 0.90

= 0.279 = 27.9%

Average Assets = $120,880 ($147,820 + 93,940) /2

September 2013

ROI = margin = turnover = Net Operating Income/Sales x Sales/Average Assets

= ($18,530/$65,370) x ($65,370/$70,880)

= 0.28 x 0.92

= 0.258 = 25.8%

Average Assets = $70,880 ($93,940 + 47,820) /2

Explanation:

Apple Inc. Income StatementFor the Fiscal Years Ended September 27 and September 28, respectively:

2014 2013

Net sales $108,400 $65,370

Costs of sales 64,580 39,690

Operating income 33,950 18,530

Net income $26,050 $14,160

Balance Sheet:

Assets

Current assets:

Cash and cash equivalents $9,580 $10,630

Short-term marketable securities 16,280 14,510

Accounts receivable, less allowances of $84 & $99 5,520 5,670

Inventories 930 1,200

Deferred tax assets 2,170 1,780

Vendor non-trade receivables 6,500 4,560

Other current assets 4,680 3,590

Total current assets 45,660 41,940

Long-term marketable securities 85,770 25,540

Property, plant, and equipment, net 7,930 22,670

Goodwill 1,060 890

Acquired intangible assets, net 3,690 490

Other assets 3,710 2,410

Total assets $147,820 $93,940

Liabilities and Shareholders Equity

Current liabilities:

Accounts payable $14,780 $12,160

Accrued expenses 9,400 5,870

Deferred revenue 4,250 3,130

Commercial paper 6,548 0

Total current liabilities 34,978 21,160

Deferred revenue: noncurrent 1,840 1,290

Long-term debt 23,452 17,760

Other noncurrent liabilities 10,260 5,680

Total liabilities 70,530 45,890

Shareholders' Equity:

Common stock and additional paid-in capital,$0.00001

par value, 1,900,000 shares authorized; 929,430 & 916,130

shares issued & outstanding, respectively 13,490 10,810

Retained earnings 63,200 37,320

Accumulated other comprehensive income (loss) 600 (-80)

Total shareholders' equity 77,290 48,050

Total liabilities & shareholders' equity $147,820 $ 93,940

At September 29, 2012, total assets were $47,820 and total shareholders' equity was $31,800.

b) Working Capital is the excess of current assets over current liabilities. It shows the amount of finance needed for meeting day-to-day operations of an entity. Working capital measures a company's liquidity, operational efficiency, and its short-term financial health. A healthy entity has some excess of current assets over current liabilities in order to continue to run the business operations in the short-run. Working capital can also be measured in relative terms with the use of ratios, especially the current ratio and the acid-test ratio.

c) ROE means Return on equity. It is a financial performance measure calculated by dividing net income by shareholders' equity. Since shareholders' equity is equal to a company's assets minus its debt, ROE is considered as the return on net assets. As with return on capital, a ROE measures management's ability to generate income from the equity available to it.

d) Return on Investment (ROI) is a financial performance measure which evaluates the efficiency of an investment or compares the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment's cost. As a financial metric, it measures the probability of gaining a return from an investment.

1

1 Apple Inc.

a. Calculate Apple Inc.'s working capital, current ratio, and acid-test ratio at September 27, 2014, and September 28, 2013. (Round your ratio answers to 1 decimal place. Enter "Working capital" in million of dollars.)

September 2014:

a) Working Capital = Current Assets - Current Liabilities

= $45,660,000 - $34,978,000 = $10,682,000

b) Current Ratio = Current Assets / Current Liabilities

= $45,660 / $34,978 = 1.3 : 1

c) Acid-Test Ratio = Current Assets - Inventory / Current Liabilities

= $45,660 - 930 / $34,978 = 1.3 : 1

September 2013:

a) Working Capital = Current Assets - Current Liabilities

= $41,940,000 - $21,160,000 = $20,780,000

b) Current Ratio = Current Assets / Current Liabilities

= $41,940 / $21,160 = 2 : 1

c) Acid-Test Ratio Current Assets - Inventory / Current Liabilities

= $41,940 -1,200 / $21,160 = 1.9 : 1

b. Calculate Apple's ROE for the years ended September 27, 2014, and September 28, 2013. (Round your answers to 1 decimal place.)

September 2014

ROE = Net Income/Equity x 100 = $26,050/$77,290 x 100 = 33.7%

September 2013

ROE = Net Income/Equity x 100 = $14,160/$48,050 x 100 = 29.5%

c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 27, 2014, and September 28, 2013. (Round "Turnover" answers to 2 decimal places. Round your percentage answers to 1 decimal place.)

September 2014

ROI = Margin x Turnover = Net Operating Income/Sales x Sales/Average Assets

= ($33,950/$108,400) x ($108,400/$120,880)

= 0.31 x 0.90

= 0.279 = 27.9%

Average Assets = $120,880 ($147,820 + 93,940) /2

September 2013

ROI = margin = turnover = Net Operating Income/Sales x Sales/Average Assets

= ($18,530/$65,370) x ($65,370/$70,880)

= 0.28 x 0.92

= 0.258 = 25.8%

Average Assets = $70,880 ($93,940 + 47,820) /2

Explanation:

Apple Inc. Income StatementFor the Fiscal Years Ended September 27 and September 28, respectively:

2014 2013

Net sales $108,400 $65,370

Costs of sales 64,580 39,690

Operating income 33,950 18,530

Net income $26,050 $14,160

Balance Sheet:

Assets

Current assets:

Cash and cash equivalents $9,580 $10,630

Short-term marketable securities 16,280 14,510

Accounts receivable, less allowances of $84 & $99 5,520 5,670

Inventories 930 1,200

Deferred tax assets 2,170 1,780

Vendor non-trade receivables 6,500 4,560

Other current assets 4,680 3,590

Total current assets 45,660 41,940

Long-term marketable securities 85,770 25,540

Property, plant, and equipment, net 7,930 22,670

Goodwill 1,060 890

Acquired intangible assets, net 3,690 490

Other assets 3,710 2,410

Total assets $147,820 $93,940

Liabilities and Shareholders Equity

Current liabilities:

Accounts payable $14,780 $12,160

Accrued expenses 9,400 5,870

Deferred revenue 4,250 3,130

Commercial paper 6,548 0

Total current liabilities 34,978 21,160

Deferred revenue: noncurrent 1,840 1,290

Long-term debt 23,452 17,760

Other noncurrent liabilities 10,260 5,680

Total liabilities 70,530 45,890

Shareholders' Equity:

Common stock and additional paid-in capital,$0.00001

par value, 1,900,000 shares authorized; 929,430 & 916,130

shares issued & outstanding, respectively 13,490 10,810

Retained earnings 63,200 37,320

Accumulated other comprehensive income (loss) 600 (-80)

Total shareholders' equity 77,290 48,050

Total liabilities & shareholders' equity $147,820 $ 93,940

At September 29, 2012, total assets were $47,820 and total shareholders' equity was $31,800.

b) Working Capital is the excess of current assets over current liabilities. It shows the amount of finance needed for meeting day-to-day operations of an entity. Working capital measures a company's liquidity, operational efficiency, and its short-term financial health. A healthy entity has some excess of current assets over current liabilities in order to continue to run the business operations in the short-run. Working capital can also be measured in relative terms with the use of ratios, especially the current ratio and the acid-test ratio.

c) ROE means Return on equity. It is a financial performance measure calculated by dividing net income by shareholders' equity. Since shareholders' equity is equal to a company's assets minus its debt, ROE is considered as the return on net assets. As with return on capital, a ROE measures management's ability to generate income from the equity available to it.

d) Return on Investment (ROI) is a financial performance measure which evaluates the efficiency of an investment or compares the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment's cost. As a financial metric, it measures the probability of gaining a return from an investment.

21

21 Step-by-step explanation:

1. 8 days

2. C?

3. A

4. B

5. C

6.D

7.48

8. A

9. 1.69%

10. False

I have no clue if these are right i tried my best to get them right, if they are wrong I am incredibly sorry!

- SavageSavvy

21

21 Step-by-step explanation:

1. 8 days

2. C?

3. A

4. B

5. C

6.D

7.48

8. A

9. 1.69%

10. False

I have no clue if these are right i tried my best to get them right, if they are wrong I am incredibly sorry!

- SavageSavvy

1

1 For each year, calculate the budget deficit then make it a percentage of GDP.

Budget Surplus (deficit) = Government receipts - Government Expense

2015

Deficit as percentage of GDP = (2,329.8 - 2,682.6) / 14,573.20

= 2.4%

2016

= (2,446.3 - 2,736.3) / 14,573.2

= 2.0%

2017

= (2,568.6 - 2,791.0) / 14,573.2

= 1.5%

2018

= (2,697.0 - 2,846.8) / 14,753.2

= 1.0%

Answers rounded to one decimal place. and no signs, plus or minus, included, as per the question specification.

34

34 1. B

2. A (n ≤ 13)

3. A (2m - 7)

4. B (8x+8y)

5. School C

6. C (6.08 pounds)

7. A (5 + 3p ≥ 30)

8. A (95 + 25x + 25y)

9. D (29)

10. A (Add 3 to both sides)

11. C (Malia)

12. C (n ≤ 48)

13. TRUE

Step-by-step explanation:

1.

We need to find 8.45% of each of them so that the answer is 2.1 hours.

For 20 hours: 8.45% of 20 = 0.0845 * 20 = 1.69 hours (this is not the answer)

For 25 hours: 8.45% of 25 = 0.0845 * 25 = 2.11 hours (this is the answer)

For 10 hours: 8.45% of 10 = 0.0845 * 10 = 0.85 hours (this isn't it)

For 18 hours: 8.45% of 18 = 0.0845 * 18 = 1.52 hours (this is not it)

We see that option B is right.

2.

Macy has $95.

She buys $12.99 worth of stationery. She now was 95 - 12.99 = $82.01

She needs to keep $42 intact for skateboard, so she can spend remaining on ice-cream bars.

She can spend  for ice cream bars each worth 3.07.

for ice cream bars each worth 3.07.

Number of ice-cream bars, n, she can buy for 40.01 is  . SHE CAN'T BUY 0.03 (the fractional amount) ice-cream bars, so the maximum is 13.

. SHE CAN'T BUY 0.03 (the fractional amount) ice-cream bars, so the maximum is 13.

Answer choice A is right (n ≤ 13)

3.

We need to use the distributive property ( ) to expand and them add like terms. The steps are shown below:

) to expand and them add like terms. The steps are shown below:

Answer choice A is right (2m - 7)

4.

Total number roses is = total red roses and total white roses

total red roses = x groups of 8 in each group = 8x

total white roses = y groups of 8 in each group = 8y

Hence, total = 8x + 8y

Answer choice B is right.

5.

We divide "number of students who like sandwiches" by "total number of students" , then multiply by 100 to get the percentage. Which ever is the greatest, is the answer. Let's do for each:

School A:  %

%

School B:  %

%

School C:  %

%

School D:  %

%

School C has the greatest percentage.

6.

Subtracting 25.2 from 86 will give us the amount of flour Sam used in last 10 days.

Amount used = 86 - 25.2 = 60.8 pounds

Since he used same amount for each day, we can divide 60.8 by 10 to get how much he used each day.

So,  pounds used each day

pounds used each day

Answer is C, 6.08 pounds

7.

"Score" needs to be atleast 30. Let first round score be 5 (given) and each of the three remaining rounds's score be p. So,

Score = 5 + 3p

This SCORE NEEDS to be ATLEAST 30, which means "5 + 3p should be greater than or equal to 30"

First answer choice is right (5 + 3p ≥ 30)

8.

First day printed = 95 (given)

Second day printed = 25 barcodes per minute for x minutes = 25x AND 25 barcodes per minute for y minutes = 25y

Subtotal is 25x+25y

Total in 2 days = 95 + 25x + 25y

Answer choice A is right.

9.

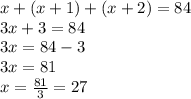

Let first number be x, so next consecutive number is x + 1 and the next one is x + 2. We take the sum and equate to 84 and solve:

Hence, the 3 numbers are 27, 28, and 29. The largest is 29, answer choice D is right.

10.

The question is

The first step would be to "isolate" the terms with x's and constant terms. So we sould take 3 to the right hand side.

Adding 3 to both sides "eliminates" 3 from left and takes it to the right.

Answer choice A is right (Add 3 to both sides)

11.

Finding the respective PERCENTAGES will give us the answers. The greatest amount is what we are looking for. Let's find it.

Zak = 15% of 56 = 0.15 * 56 = 8.4 pages

Karen = 12% of 64 = 0.12 * 64 = 7.68 pages

Malia = 14% of 68 = 0.14 * 68 = 9.52 pages

Ali = 10% of 72 = 0.10 * 72 = 7.2 pages

We see that Malia reads the most. Answer choice C is right (Malia)

12.

Subtracting John's weight (100) from maximum the elevator can carry (340) will give us the amount alloted for the packages.

Amount alloted for packages = 340 - 100 = 240

Since each package weights 5, the MAXIMUM is

It means "the number of packages, n, can be LESS THAN or EQUAL to 48"

Answer choice C is right (n ≤ 48)

13.

We can simplify the expression by using distributive property ( ) and collecting like terms to fully simplify the expression. let's do it:

) and collecting like terms to fully simplify the expression. let's do it:

Indeed the expression is equal to "20 - 5x" (the two terms are just placed differently)

Answer is TRUE

It will provide an instant answer!